When a startup arrives at a stage of product market fit to show steady increases in revenue, my evaluation as an investor expands to include looking for evidence that the leaders are actively engaged in working ON the business itself as the team builds towards scaling up.

Experience helps pick up pattern recognition across a variety of decisions like how to hire winners, manage cash and keep the team on a focused path by everyone working on the right stuff.

But what about first time entrepreneurs, particularly those without prior experience in managing teams?

Founder vision and passion may be there, as well as the persistence needed to stay the course through tough times, but if the business is to scale up – that also means the entrepreneur CEO has to quickly adapt to challenges that each new phase of company growth brings. For rookie CEOs that invariably means navigating through situations he or she has never seen before.

Work Myself Out of A Job

As an active startup investor, I didn’t think enough about this before now. In part due to not having put enough emphasis on how a decade of management experience before starting TriNet was a foundation for my own entrepreneurial journey.

At the outset, perspective about not being the bottleneck for decisions others on the team could make was already part of my mindset. I had seen what worked and didn’t in my prior efforts to empower others so I was tuned to the value of working myself out of a job.

Founders with the startup being their first managerial role are having to learn these basics on the fly, while also carrying the burden of startup pressures on their shoulders as they navigate through unchartered territory every day.

It’s easy to be totally consumed with top of mind priorities like finding new customers and serving existing ones, supporting team members to keep them productive and expanding the team to fill growing demand.

Those and other day to day activities involving immediate people and resource allocation decisions get in the way of putting time into things like refining strategic direction of the company, driving changes in the company’s internal business processes, culture and public identity, finding investment capital as well as developing their own leadership skills for the next stage of company growth.

Working ON the business

Micheal Gerber’s classic “The E-Myth” popularized the notion that if you looked at any truly successful entrepreneur with an enduring company you’ll find someone who committed significant energy to improving the business itself at the same time they were also navigating through significant revenue growth.

Anyone growing a company from scratch knows how consuming the revenue growth and service side can be – so how does one find the time needed to guide improving the business itself?

Scaling up Requires a Capable Management Team

Organizations are only as strong as their weakest links near the top. A high performing team is one that leads together with unifying purpose and consistency in living a company’s core values as everyone puts the overall company ahead of any single individual or department.

But if the early stage team is also new to managing others, as the volume of necessary decisions grow (resource allocation, who to hire, changes to internal processes etc.), decisions which might routinely be made by a manager in a slightly larger organization are instead discussed among the founders to build consensus.

This all happens without much recognition that the time involved to do so inevitably slows down the needed pace of change for the company to adjust to new scale and demands.

There are no rule books out there saying if you are at a certain size this is how decision making should work.

The Founder/CEO sets the tone of evolving who decides what, with the goal of pushing decisions down the hierarchy to the lowest level possible while still having the company be coordinated with the team in sync with each other.

As the business prospers, we’ll all be successful

As soon as we started scaling up at TriNet, our first managers came in at below market salaries but offset with equity upside. There was lots of risk as our industry was unknown and growth prospects uncertain.

It all worked out as that first group of managers came in with leadership experience that made it possible for us to scale up.

Some transitioned out after a few years, several others stayed on for 10 years or longer. And I’m not thinking there was much regret on the part of anyone who took part in the early leadership team as they were all successful in transitioning to other roles where their TriNet experience was valued. Those that exercised stock options and held their shares also reaped significant financial gains downstream.

CEO’s have the opportunity to articulate an inspiring vision for what individual and company success looks like, while at the same time being realistic with regards to expectations. Leaders who are credible in striking this balance attract high performers to the management team who in turn model that behavior as they become critical links for building the company to the next level.

Developing The Company Requires Commitment

Even if the Founder CEO is able to attract experienced managers to the team, the need for management development to work ON the business will be ongoing.

Throughout my TriNet CEO journey I sought out meaningful development opportunities, sometimes as part of industry or entrepreneur conferences but especially where there would be a gathering of peer CEOs who were seeking to learn more about the same issues I was struggling with.

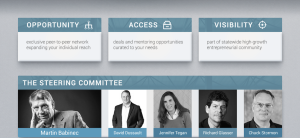

Extra value came from opportunities where those peers then had contact outside the learning session. Building an expanding peer network requires a time investment that also carries the opportunity cost of stepping outside the business to participate.

I could get pretty charged up after hearing wisdom from a world class speaker on some aspect of company development, but then had to be thoughtful about how to bring that new knowledge back into the company.

Our approach included devoting at least one full day per quarter to strategic planning to focus working ON the business with prepared topics addressing known bottlenecks as we generated new approaches to meet higher production and sales growth we were building towards.

In some cases, we enhanced group learning with outside facilitators. We wouldn’t do it often, but as the team grew this proved to be an additional avenue to help get everyone on the same page for important themes we needed to be in sync.

Define and Work the Plan

With so many other things requiring attention in the business, the only way to mark steady progress is to incorporate company development into the operating plan and then track progress against measurable company goals.

We sought out and followed proven structures that helped us learn from what worked well for others. This helped not only on how to frame company development goals but the internal management reporting that cascade down from the overall corporate plan with operating metrics that were meaningful to the people doing the work inside each company department and work unit.

Supplementing written guidance and goals with an outside coach is another way to insure there are eyes on progress against defined management goals that go beyond financial measures and other targets the Board of Directors should be holding the CEO accountable for.

None of this is easy nor will come together with a process that stays rigid. Like most everything in growing a company, the journey begins with commitment to get it done followed by continuous iteration on the approaches used.

With an expanding team, everyone needs to be engaged in contributing to strategic development even while totally consumed with challenges of dealing with rapid growth.

But I’ll argue that unrelenting attention to working ON the business can be the key differentiator separating those who never make it past the startup stage from those who evolve to become true companies.