Colleagues at Endeavor hosted me for a podcast to talk about investing and operating venture backed companies during recessionary times.

Endeavor entrepreneurs and many others are experiencing the effect of high interest rates and depressed public company multiples as investor backed companies start testing the market to raise their next round of funding.

With Endeavor’s audience focused primarily on companies already in growth stage, they were specifically interested in speaking with people who had experienced multiple recessions.

Three Prior Tech Wrecking Recessions

For me, there were three distinct pullbacks driving venture investors to run for cover. Each followed a frothy VC investment period with new heights in valuations immediately preceding these resets:

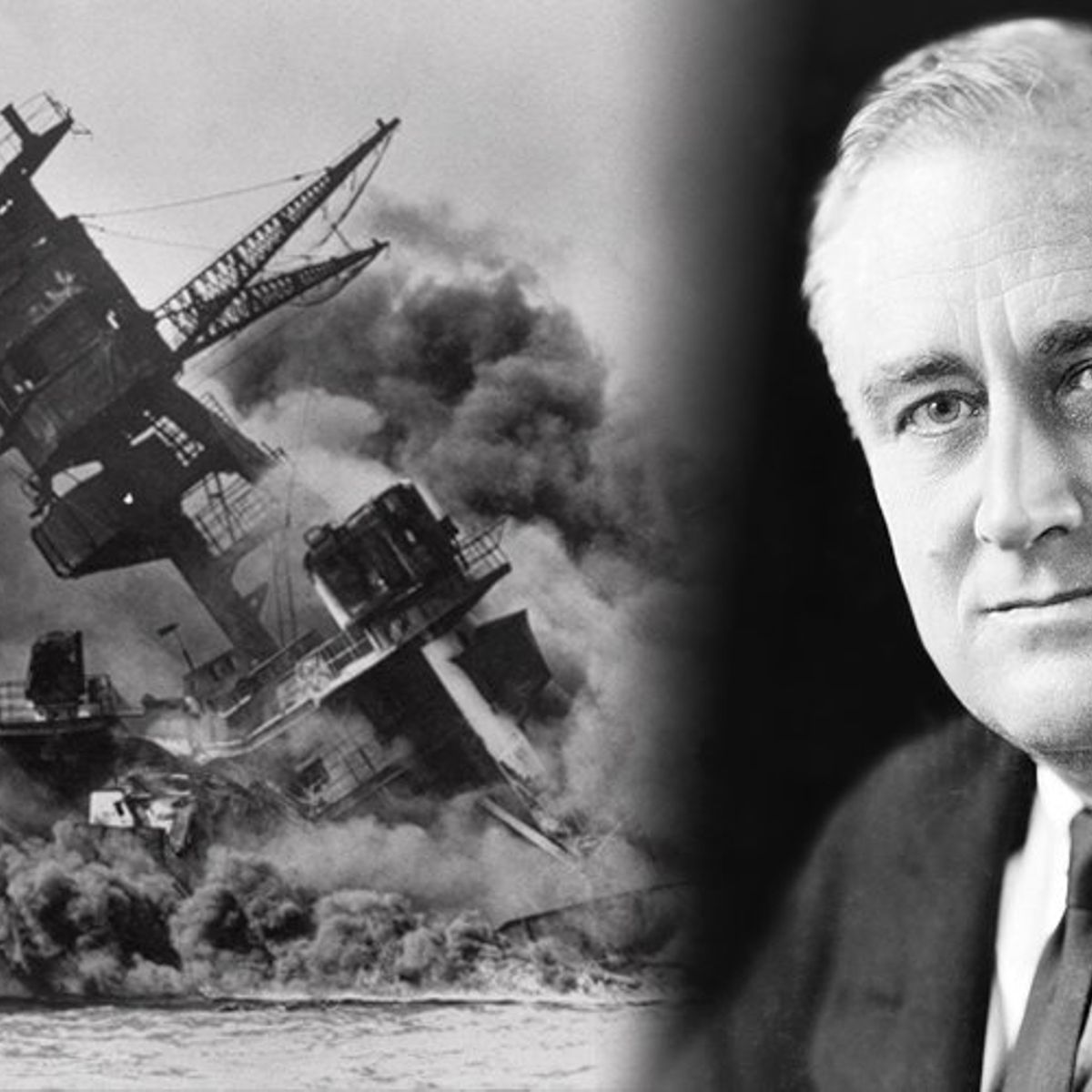

- 2000 – 2002 Dot com bust + post Sept 11 recession

- 2008 – 2009 Real estate and financial markets crisis

- 2020 – 2021 Initial 18+ months of Covid pandemic

I’m far from unique for having worked through each of these resets. The first two I was on the operating side of the business as CEO and Chairman at TriNet, while during the 2020 venture pullback I was on the investor side doing what I could to help UpVentures portfolio companies make hard decisions following the unexpected falling off the cliff valuation drops at the start of Covid.

Have a listen to the podcast if you’re interested in hearing more about what prompts me to think it may be a couple of years or longer before we get back to late 2021 private company valuations.

Recessions teach us that failing to recognize macro forces beyond our control can too easily result in horrific consequences to once promising companies. Much heartache can be avoided if leaders move quickly to face reality in making the hard decisions.

Whether you’re an operator or investor, if you believe “only the paranoid survive,” it’s necessary to look beyond founder optimism thinking that past momentum points towards everything just working itself out.

Got 3 Minutes? Listen to one segment

Open up the podcast here and jump to a specific topic of interest by advancing to any of the following time stamps in the podcast:

> 1:55: How is the economic outlook different today compared to a year ago? Where’s it going for VC backed companies and how long will the recession last?

> 4:00: Why public market valuations are going down and how that affects private companies seeking funding.

> 7:42: How does the current economic cycle compare to the dot-com bust of 2000/2001 as well as the 2008/2009 recession.

> 9:41: Insights from leading a company during recessionary times, including TriNet’s aborted IPO during the 2000 “dot bomb” downdraft

> 13:33: Why running a company during a recession requires Wartime Leadership that accepts macro reality, making the hard decisions and figuring out how to keep the right people you want in foxhole with you when you’re under fire

> 19:40: What investors can do to support management in making hard decisions. How management leverages data to support, track and adjust a realistic financial plan

> 22:48: Why it’s a great time to be an entrepreneur, including outside major tech hubs

> 24:31: Connecting entrepreneurs to resources is a common social impact thread across UpVentures Capital, and non profits Upstate Venture Connect, Entrepreneurs Across Borders and UpMobility Foundation

> 27:49: “Call me crazy” moment: Running as an independent candidate for U.S. Congress in 2016 and how that evolved to a committed journey inside a national movement to improve democratic processes in New York and the United States

> 29:35: Most Inspirational CEO: Jack Stack + how the Great Game of Business shaped TriNet’s trajectory

> 31:10: Best Business Advice Ever Received: From Mitch Kertzman – Not getting hung up on founder’s percentage ownership of the company

SVB Collapse a New Risk Factor

Since the podcast was recorded prior to Silicon Valley Bank’s demise, ripple effects from that closure are still unfolding. Certainly, that includes investor discovery of a new financial risk factor for the venture ecosystem further depresses valuations beyond the other recessionary factors described in the podcast.

Endeavor Helps Scale Ups

Endeavor is a non-profit leading global community of, by, and for high impact entrepreneurs. I joined their Western NY Board of Directors last year as part of my mission in connecting high growth founders to resources they need to scale companies. Endeavor is a truly global, mature non-profit built on a Pay-it-forward ethos such as I’ve described in More Good Jobs. The Endeavor board role is helping me see best practices I hope to carry over to other non-profits I’m involved with building community like Upstate Venture Connect, Entrepreneurs Across Borders and the Seasoned Entrepreneurs Gathering Exchange.

Related posts: